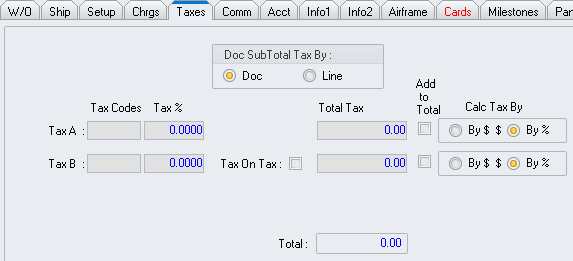

Purpose:

To

define the elements displayed on the Taxes

tab of the Maintenance XL Work Order

window.

Doc SubTotal Tax By group box - Select

the level at which taxes will be applied: by document ()

or line ()

Tax Details Section

Located in the lower portion of the tab.

Each line of this section applies to one of the two available tax rates.

- Tax Codes

column - Displays the code related to the tax rate. The user may modify

the tax rate (link pending)

by left-clicking the ellipsis

while

in edit mode(adj) in any document, left-click the Edit button (most commonly located in the document window toolbar); after the button is selected "[Editing]" should appear in the document window title bar.

while

in edit mode(adj) in any document, left-click the Edit button (most commonly located in the document window toolbar); after the button is selected "[Editing]" should appear in the document window title bar.

- Tax % column

- Displays the tax rate in terms of percentage. The value in this

field may be modified if the tax is set up to be applied by percentage

(in the Calc Tax By column) at the

document level (in the Doc SubTotal Tax

By group box). The value in this field will be calculated if

the tax is set up to be applied (1) by percentage at the line level

or (2) by currency amount.

- Tax on Tax

flag - Applicable to Tax B only. When the flag to the right of the label is checked

,

Tax A will be included in the calculation

when Tax B is applied.

,

Tax A will be included in the calculation

when Tax B is applied.

- Total Tax

column - Displays the tax rate in terms of currency amount. The value

in this field may be modified if the tax is set up to be applied by

currency amount (in the Calc Tax By

column) at the document level (in the Doc

SubTotal Tax By group box). The value in this field will be

calculated if the tax is set up to be applied (1) by percentage or

(2) by currency amount at the line level.

- Add to Total

column - When the flag in this column is checked

,

the tax will be added to the total on the W/O

tab.

,

the tax will be added to the total on the W/O

tab.

- Calc Tax By

group boxes - Select how taxes will be applied: by currency amount

() or percentage ().

Total field - Displays the cumulative

amount of all taxes.

,

Tax A will be included in the calculation

when Tax B is applied.

,

Tax A will be included in the calculation

when Tax B is applied. ,

the tax will be added to the total on the W/O

tab.

,

the tax will be added to the total on the W/O

tab.